Services

Our accountants provides outstanding tax services to all clients. No client is too small or too big! We serve our communities with high integrity, high quality, professionalism, and genuine commitments.

Income Taxes for Deceased

Filing the necessary tax returns after a person’s death is a complex and detailed process that requires strict adherence to IRS regulations.

In summary, addressing a decedent’s tax obligations involves filing:

• Form 1040 (Final Personal Tax Return)

• Form 1041 (Estate Income Tax Return)

• Form 706 (Estate Tax Return, if applicable)

Income Tax Preparation

Our accountants use tax strategies that are most beneficial for our clients. We are up-to-date and current with federal, state, and local tax regulations. We work closely with clients to achieve their objectives providing the most beneficial approach in the short and long term. Providing our clients with a clear understanding of our process is a key factor to our success. We use appropriate adjustments, allowable deductions, and credits to keep our clients’ taxes economically to a minimum.

Tax preparation process: Our accountants will interview clients and review prior three years of return, listen to clients and select relevant information that can be useful. We take a caring approach and time to assure completeness and full understanding of clients current tax position.

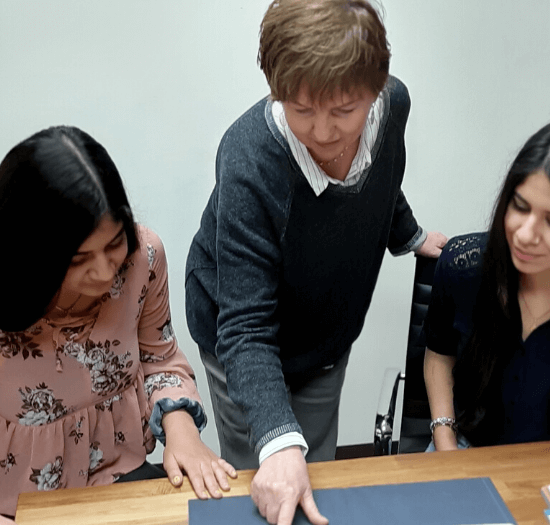

Accounting & Training

Accounting projects range from analyzing financial information, posting adjustments, compiling financial statements to assist clients in reconciliation of accounts. Our accountants focus on optimizing accounting procedures, and forecasting future profits using current technology.

We will also be looking for financial areas needing improvement, and our consulting services in person will target most critical area of your business.

Rather than managing day-to-day transactions, as bookkeepers do, our accountants will train you to use technology and expedite the process of downloading all transactions online and to use your banks automated system in paying all your bills.

Audit Representation

Have you received a letter from the IRS (Internal Revenue Service)? Our accountants will place you on our priority list. We will do an assessment of your most current taxes and contact the IRS professional line to do our due diligence before we dispute your bill or work on an Offer in Compromise if necessary.

We understand the level of stress caused by the State or Federal agencies letters or audit. Having a tax professional accountants representation on your behalf, during an IRS tax audit, is one of the ways to insure fairness, and reassure that your return is in compliance.

Small Business Service

Starting a business is a multi-step process that we are able to make easy. Our accountants advice allows our clients to make the right choice in choosing which type of taxation organization is best for them. We assist in filing for permits and licenses, and drafting your business plan.

We will mentor you throughout the process when you’re on your own working on your operational side of your business. Our proven expertise allows us to make sure you do it right.

QuickBooks® Support

We are Certified accountants ProAdvisors for QuickBooks® Advisor since the first version was released in 1998. As such, our deep knowledge and experience is a great value to our practice.

QuickBooks® is a platform that offers many features and we are able to utilize them correctly & efficiently from the start. We start with efficient setup and customization of the selected models. In return our clients advance quickly with small effort and are able to have daily access to reliable and accurate reports.

Contact Us To Get Started

Reach out to us for your free initial consultation.

Address

Palmer Office Executive

8586 Potter Park Drive, Sarasota, FL 34238

Email: ela@ericksoncpa.net

Phone: 425-829-4835